By Gates Dearen

| Tax Day Reminder (Photo credit: SalFalko) |

But before you sit down to file your taxes online, or work

with your accountant, remember that by owning a home, you may qualify for some

of the above mentioned tax breaks. In order to reap, you must sow, which means

you’re going to have to go through the process of itemizing your taxes to take

advantages of the deductions. Potentially time consuming? Yes. A hassle?

Perhaps, but once you’ve done it, the benefits are usually worth the time and

effort – especially if you replaced your windows, skylights or exterior doors

last year. You may be able to help pay for those upgrades by taking advantage

of certain tax breaks. You should always seek the advice and counsel of

qualified tax accountant or attorney before claiming any deduction. Now

that the disclaimer is out of the way, let’s look at ways you can save money.

Home Improvement Loan

Interest

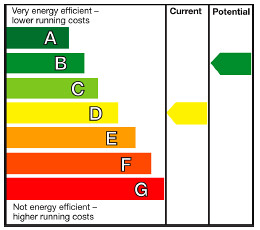

| Energy Efficiency (Photo credit: London Permaculture) |

Residential Energy Efficiency

Tax Credits

- Windows must be installed between January 1, 2012 and December 13, 2013.

- Products must be installed in the homeowner’s primary residence.

- Products must meet Energy Star published criteria for the Energy Star Climate Zone in which they are installed.

Furthermore, if you claimed an energy efficiency credit in a

previous taxable year, please consult a tax professional or visit www.irs.gov

to determine if you’re still eligible.

What Makes a Window,

Skylight or Door Energy Star qualified?

These products are manufactured by an Energy Star partner, they’re

independently tested and certified by the National Fenestration Rating Council

(NFRC), and they meet stringent energy efficient guidelines as defined by the

U.S. Department of Energy (DOE). The DOE doesn’t require any specific

technologies, yet certain product features are common.

Homeowners can claim a Federal Tax Credit for upgrading their primary residence with energy efficient windows and exterior doors.

It’s important to keep in mind that, just like clothing, some

windows and skylights are better at insulating you from the cold, whereas

others are better at keeping you cool when outside temperatures are warm. Performance

criteria for windows and skylights are based on four climate zones: Northern,

North-Central, South-Central, Southern) and ratings that have been certified by

the NFRC.

| Education Tax Deductions (Photo credit: StockMonkeys.com) |

In general, doors provide more insulation than windows or

skylights, based upon the amount of glass your exterior doors have, called the “glazing

level” and ratings certified by the NFRC.

In addition to claiming a tax credit, if you’ve replaced

your windows, skylights or external doors, there are other steps you may take

to save money on your taxes. Again, when in doubt, it’s always best to seek the

advice of a qualified tax consultant or attorney.

- · Construction Loan Interest - If you take out a construction loan to build a home, you may qualify to deduct the interest. The IRS only allows a deduction for mortgage interest if the loan relates to your principal residence or a second vacation home used for personal purposes.

- · Home Office - If you use a portion of your home exclusively for the purpose of an office for your (small) business, you may be able to claim a deduction on your taxes for costs related to insurance, repairs and depreciation. If you upgraded your windows and an exterior door associated with your home office, these too may be considered deductions.

- · Mortgage Insurance Premiums - You may be able to deduct the premiums paid for private mortgage insurance for your principal residence and for a non-rental second home.

- · Mortgage Interest Paid at Settlement - If you’ve bought a new home within the past year, on a mortgage of up to $1 million, you can deduct the interest you pay at settlement if you itemize your deductions on Schedule A (Form 1040).

- · Points - Did you pay points in order to obtain your home mortgage? These fees are included on the income tax deductions list and can be deducted as long as they are associated with the purchase of a home

- · Property Taxes - If they’re based on the assessed value of the real property, you can deduct your state and local property taxes.

- · Selling Costs - If you sold a home in the past year, you may be able to reduce your income tax by the amount of your selling costs, which can include title insurance, advertising expenses, broker’s fees, and repairs.

In this article, I covered many of the different types

of tax breaks the IRS allows for homeowners and individuals and business

upgrading their homes and home offices via construction, home improvement loans

and energy tax credits. If you found this article useful, pass it on to your

friends and neighbors. If you have a comment related to this article, please

post it in the Comments section of this blog. It's been my pleasure informing

you about these tax breaks. I look forward to our next visit.

Gates Dearen and Richard Walden: Local owners of HomeRite Windows and Doors in Jacksonville, Florida.

We have been serving the building products industry in Florida for over 25

years. We know the products, the industry, the market and what adds

great value to a home. Our approach is a little different.

We strive to match the homeowner with the right windows for

their home and budget. We understand that home improvements can be a

hassle. We’re here to make life easier with first-rate, energy efficient

products; affordable prices; and expert, award-winning installers that employ the best

practices and respect your home as if it were their own.

Related articles

One thing I learned in many years in the casinos is to never leave any chips on the table.

ReplyDelete